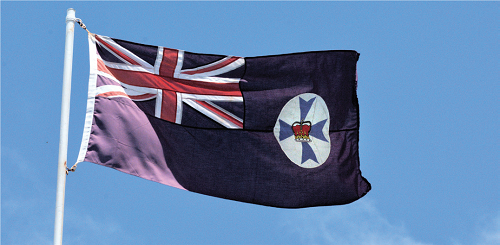

QLD 2020 Key Policies

Clive Palmer’s United Australia Party’s Key Policy

The Clive Palmer’s United Australia Party is a party for all Queenslanders, regardless of race, colour, cultural background or religious beliefs. Our policies are geared to helping improve the lives of hardworking Queenslanders who contribute to the social, economic and cultural fabric of our nation.

Zonal Taxation

Regional communities are the backbone of the state and we aim to stimulate economic growth in rural areas.

Brisbane is bursting at the seams and we face a future of heavy congestion, serious housing affordability issues and mounting cost of living pressures.

By providing tax incentives, we can decentralise Queensland and encourage people to move to or settle in regional areas.

KEY POINTS of Zonal Taxation

- We will stimulate economic growth in rural areas through a 20% tax concession for people living in rural areas. The concessions will apply to people living more than 200kms from Brisbane.

- The policy has the potential to attract high quality professionals and new businesses to regional areas.

- Zonal taxation will assist our farmers’ capacity to cope with drought and natural disasters.

- Property and land development will be boosted with increasing regional population.

- We can ease the strain on infrastructure in our cities by thinning urban populations.

- Zonal taxation isn’t new – it existed under Liberal governments in the 1960s and is constitutional under Commonwealth laws.

Abolition of Payroll Tax

Payroll tax is a state-based tax assessed on wages paid by an employer to its employees, when the total wage bill of an employer exceeds a threshold amount. In Queensland, businesses become liable once their wage bill reaches $1.3 million a year.

Payroll taxes creates a negative incentive for businesses to employ people. As such we should abolish the tax and encourage Queensland businesses to create jobs and hire a greater number of employees.

A focus on increasing economic activity will lead to a higher standard of living for all Queenslanders.

Reintroduction of the Upper House in Queensland

Queensland is the only Australian state Parliament without an upper house.

An upper house in Queensland is not a new concept, having been abolished in 1922.

Parliamentarians need to be held accountable, as such the reintroduction of an upper house will increase scrutiny and oversight.

A house of review is able to provide a check on executive power and provide greater stability for voters, industry and government.

Halt coal seam gas until water table secured

A secure water table is imperative to the agricultural sector. Short term profits at the expense of the long term viability of the agricultural sector is not in the best interests of Queensland.

A secure water table is imperative to the agricultural sector. Short term profits at the expense of the long term viability of the agricultural sector is not in the best interests of Queensland.

Until technical improvements are demonstrated, a temporary break from coal seam gas sequestration is required in order to protect the agricultural industry.

Once technical improvements are shown to be unquestionably safe, the practise may be re-examined by the party.

Abolishment of Land Tax

Queenslanders should not be punished for owning property. The removal of land tax will encourage citizens and companies from other states to invest in Queensland property. The introduction of new capital investment will bring employment, wealth and prosperity to Queensland.

Queenslanders should not be punished for owning property. The removal of land tax will encourage citizens and companies from other states to invest in Queensland property. The introduction of new capital investment will bring employment, wealth and prosperity to Queensland.

Queenslanders should be encouraged to invest and create a successful future for themselves and their family.

The removal of land tax will result in the extra available money circulating within the economy, boosting demand, production and allowing the Queensland economy to grow.

Abolishment of stamp duty

Stamp duty is a negative tax on activity rather than on any economic output or profitability.

Stamp duty is a negative tax on activity rather than on any economic output or profitability.

The tax creates a large burden during the purchase of property, adding to poor housing affordability and distorting economic decisions.

Stamp duty punishes first home buyers, upsizers, retirees seeking to downsize and parties looking to relocate.

The abolishment of stamp duty will lead to more property sales and allow citizens to relocate and invest as per their needs and objectives.

First farm buyers grant with concessional interest rate for five years

In order to attract young farmers to Queensland, a concessional loan program will be established for first farm buyers. The first farm buyers grant is aimed to encourage farmers to invest in the Queensland market and create a better, more prosperous future for their family.

In order to attract young farmers to Queensland, a concessional loan program will be established for first farm buyers. The first farm buyers grant is aimed to encourage farmers to invest in the Queensland market and create a better, more prosperous future for their family.

Encouraging primary producers is of critical importance to the state economy. The program will enable first time farm buyers access to a concessional loan for an initial five year period. This will offer the recipient sufficient time to establish and secure their prime production operation.

Prioritise regional development

The regions suffer from underinvestment. For decades this state has been devoid of major project developments.

The regions suffer from underinvestment. For decades this state has been devoid of major project developments.

Key regional projects should be fast tracked and initiated. New dams and other key critical infrastructure shall be constructed in order to kick start the economy and provide a backbone for private business to flourish.

Mineral Processing in Australia

Queensland is failing to maximise revenue from our prized mineral resources by continuing to send unprocessed ores overseas.

If we invest in downstream processing, which essentially is having more stages of the mining process occur in Queensland rather than offshore, it will result in much higher returns and stimulate both economic growth and job creation.

Mineral ore sells for under $700 a tonne. Finished, refined product can go for around $75,000 a tonne. Despite high wages and energy costs, Japan has become the world’s third largest economy, largely on the back of Australian resources.

Queensland can maximise its return from our mineral resources and ensure our communities see real benefit in the way of jobs and infrastructure for the future.

We should look after the economic interests of Queensland and our people before those of other countries. Mineral resources are Australia’s family silver, and we’re selling our family silver on the cheap.

Electricity Prices

Queenslander’s pay some of the highest power prices in the world – more than twice what Americans pay per kWh.

This is largely driven by consumers being forced to pay back, through their power bills, huge loans taken out by electricity companies.

This is largely driven by consumers being forced to pay back, through their power bills, huge loans taken out by electricity companies.

These loans were used to build a power infrastructure network we never needed because demand is falling due to factors such as improved energy efficiencies and increased use of solar.

Worse still, being government loans, the interest rates issued were below 5%, yet they are charging customers more than 10%.

We will pressure the government to resume these loans and reissue them with fairer terms for Queenslanders. Australian consumers are being ripped-off by power companies.

Every household and every business is paying for excessive and unnecessary over-investment in our electricity network by the power companies. Electricity prices have gone up 50% in the last 10 years. We support voluntary write-downs of network infrastructure to remedy over-investment and reduce prices for consumers. Successive governments have failed to address cost impact of introducing higher ratios of renewable energy into our power mix.